Category: Uncategorised

-

Commercial Bridging Loans – The Key Facts

As the name suggests, a commercial bridging loan is a short-term loan secured against a commercial property. Quick to secure, commercial bridging loans can be an attractive option for those looking to secure a commercial property, carry out light works to an existing business premises, or refinance an existing commercial property. They can also be…

-

Watch NOW – ‘What does the specialist finance industry need in 2023 and beyond?’

We recently held a virtual roundtable in partnership with Bridging & Commercial magazine, which you can now watch in full below: ‘What does the specialist finance industry need in 2023 and beyond?’ With a panel made up of industry experts, this lively discussion touched on numerous talking points, such as ‘What are the industry’s biggest…

-

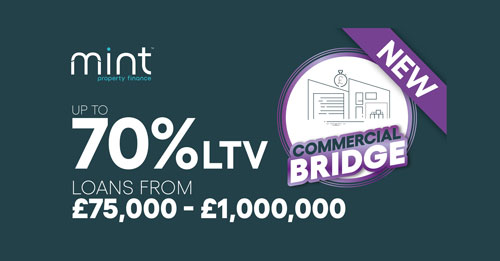

Introducing Our Brand New Commercial Bridge Product

We’re pleased to announce the launch of our new commercial bridging product as demand for our range of specialist finance loans continues to grow. The new market-leading Bridge joins our portfolio of Power Products, providing an even greater breadth of options to Brokers and Borrowers looking for alternative finance. Catering for those looking to purchase…

-

Watch our Roundtable NOW – “FSMA Legislation: Doing the right thing as an industry”

You can now watch our roundtable in partnership with Mortgage Introducer in full: “ FSMA Legislation: Doing the Right Thing as an Industry”. With an expert panel made up of some of the industry’s brightest minds, this lively discussion is a must-watch for anyone engaged in the lending sector. Several key points and themes are…

-

What Is A Second Charge Bridging Loan And Is It Right For You?

Spotted a great investment property or potential holiday let but falling short on the total funds? Looking for a short-term cash investment for your business? Or maybe you’re looking to refurbish a rental property to give it a new lease of life. If this sounds familiar, then second charge bridging finance could be the solution…